NAD Terms & Conditions

In these Terms and Conditions (“Terms”), references to “You”, “Your” and “Yours” refer to the customer of Setel Ventures Sdn Bhd (Registration No: 201901000991: 1310317-A) (“Setel”) and/or Setel Wallet user who uses the National Addressing Database (“NAD”) and references to “We”, “Our”, “Ours” and “Us” refer to Setel.

These Terms govern Your use of the NAD provided by Us and shall be read in conjunction with Setel Wallet User Terms and Conditions available at App Usage Terms & Conditions.

1. Definitions

- “Account” means an E-money account offered by issuers of e-money and all types of deposit accounts offered by banks, except for fixed deposit accounts. This shall include, but is not limited to, all types of conventional and/ or Islamic savings accounts, current accounts, investment

accounts, virtual internet accounts. - “DuitNow Transfer” means a service which allows customers to initiate and receive instant credit transfers using a recipient’s account number or DuitNow ID.

- “DuitNow ID” means an identifier of an account holder such as a mobile number, NRIC, passport number, army number or police number (in the case of an individual) or business registration number (in the case of a corporate customer) or any other identifiers as may be introduced by the NAD Operator from time to time.

- “E-money account” means a payment instrument that stores funds electronically in exchange for funds paid to the issuer of e-money and is able to be used a means of making payment to any person other than the issuer of e-money.

- “Malware” means computer viruses, bugs or other malicious, destructive or corrupting software,

code, agent, program or macros, and/or phishing or social engineering schemes which utilise computer software or telecommunications to obtain personal data or any other personal information for malicious or fraudulent purposes. - “National Addressing Database (NAD)” means a central addressing depository established by the NAD Operator that links a bank or an e-money account to a recipients DuitNow ID and facilitates payment to be made to a recipient by referencing the recipient’s DuitNow ID.

- “NAD Name Enquiry” means a service which returns the name of the owner who has registered its DuitNow ID in NAD.

- “NAD Operator” means Payments Network Malaysia Sdn Bhd (PayNet) (Company No.: 200801035403 [836743-D])

- “Personal Data” means any information in respect of commercial transactions that relates directly or indirectly to a customer, who is identified or identifiable from that information which includes, but not limited to, the customer’s name, address, identification card number, passport number, banking information, email address, and contact details.

- “Common ID” means a unique identification of a customer which links all DuitNow IDs registered by the customer such as the customer’s NRIC, army number, or police number, or for non- Malaysians, passport number.

2. The NAD service

2.1 The NAD service allows You to link an Account that You have with Us to Your DuitNow ID.

2.2 By linking Your DuitNow ID to Your Account, You have the option of receiving incoming funds via DuitNow or any other payment services that address payments using Your DuitNow ID.

2.3 When You register Your DuitNow ID in NAD, You will also provide Us with Your Common ID which will be linked to Your Account with Your registered DuitNow ID. Your Common ID will be used by other NAD participating banks for the purpose of identifying You, as part of facilitating the DuitNow service.

2.4 You may link more than one of Your DuitNow ID to the same Account. However, You may not link a particular DuitNow ID to multiple Accounts.

3. Modification and Deregistration of your Duitnow ID

3.1 You may update or change Your DuitNow ID that is linked to Your Account via the channels made available to You. We will require a reasonable notice period to effect such changes or update.

3.2 You understand and agree that Your DuitNow ID that is linked to Your Account may be deregistered by You or by Us, due to the following circumstances:

3.2.1 You wish to transfer Your existing DuitNow ID to another Account in another bank/ e-money issuer;

3.2.2 You have changed/updated Your DuitNow ID;

3.2.3 You have closed Your Account that is linked to Your DuitNow ID;

3.2.4 the mobile number which You have provided to Us as Your DuitNow ID has been terminated and recycled for use by another person;

3.2.5 after a period of inactivity; or

3.2.6 upon investigation, We find out that You or Your DuitNow ID is potentially involved in any fraudulent activity(s).

3.3 You will receive a confirmation of de-registration from Us via Setel push notification as soon as the de-registration is confirmed.

4. Your Information

4.1 You represent and warrant that the DuitNow ID used for registration in NAD belongs to You, is correct, complete and up-to date for the use of the service and You will promptly notify Us if there is any change to the DuitNow ID information provided to Us.

4.2 You acknowledge and agree that other NAD participating banks/ e-money issuers may perform a NAD Name Enquiry of Your DuitNow ID for the purpose of verifying/identifying Your name to Your registered DuitNow ID, as part of facilitating the DuitNow service.

4.3 You acknowledge and consent to the disclosure of Your DuitNow ID, Your Common ID and other relevant Personal Data to the NAD Operator for its processing, storing, and archival and disclosure to the sender of funds or merchants under the DuitNow services, Our affiliates, service providers, other NAD participants and third parties offering the DuitNow service and their respective customers, and in accordance with Setel Group Privacy Statement available at Setel Group Privacy Statement.

4.4 You acknowledge and agree that We may disclose your DuitNow ID information to anyone who We are under an obligation to disclose information to under the law or where it’s in the public interest, for example to prevent or detect fraud and abuse.

5. Data Protection

5.1 Your consent and Our right to disclose information shall be in addition to, and without prejudice to the rights accorded to You under the Personal Data Protection Act 2010 and any other applicable laws in Malaysia.

5.2 We will only disclose, use and process Your DuitNow ID for the purpose of facilitating the DuitNow service.

5.3 We have in place, reasonable security measures (both technical and organisational) against unlawful or unauthorised processing of Your DuitNow ID.

5.4 We will notify You as soon as practicable if Your DuitNow ID is lost, destroyed, or becomes damaged, corrupted or unusable.

6. Liability

6.1 We and the NAD Operator shall not be liable for any losses or damage You may suffer as a result of, including but without limitation:

6.1.1 Your failure to maintain up-to-date information and Your failure to provide accurate information to us;

6.1.2 Our compliance with any instruction given or purported to be given by You which is apparent to a reasonable person receiving such instruction;

6.1.3 any misuse or any purported or fraudulent use of Your DuitNow ID including instances whereby online fraud is perpetrated by way of any Malware;

6.1.4 any disclosure of any information which You have consented to Us collecting, using or disclosing or where such collection, Use or disclosure is permitted or required to be disclosed under the applicable laws in Malaysia.

7. Miscellaneous

7.1 You acknowledge that We have the right to change, vary or modify these Terms by providing You with thirty (30) days notice in such manner as We deem fit and You agree to be bound by such Terms as cancelled, revised or modified.

7.2 These Terms shall be construed in accordance with the laws of Malaysia and You agree to submit to the non-exclusive jurisdiction of the courts of Malaysia.

III. Duitnow Transfer Terms & Conditions

In these DuitNow Transfer Terms and Conditions (“Terms”), references to “You”, ”Your” and “Yours” refer to customer of Setel Ventures Sdn Bhd (Registration No: 201901000991: 1310317-A) (“Setel”) and/or Setel Wallet user who is utilising the DuitNow Transfer service and has an account with Setel and references to “We”, “Our”, “Ours” and “Us” refer to Setel.

1. Definitions

- “Business Day” means any calendar day from Monday to Friday, except a public holiday or bank holiday in Kuala Lumpur.

- “DuitNow Transfer” means a service which allows customers to initiate and receive instant credit transfers using a recipient’s account number or DuitNow ID.

- “DuitNow ID” means an identifier of an account holder such as a mobile number, NRIC, passport number, army number or police number (in the case of an individual) or business registration number (in the case of a corporate customer) or any other identifiers as may be introduced by the DuitNow Operator from time to time.

- “DuitNow Operator” means Payments Network Malaysia Sdn. Bhd. (Company No.: 200801035403 [836743-D]).

- “National Addressing Database (NAD)” means a central addressing depository established by the NAD Operator that links a bank account or an e-money account to a recipients DuitNow ID and facilitates payment to be made to a recipient by referencing the recipient’s DuitNow ID.

- “Personal Data” means any information in respect of commercial transactions that relate directly or indirectly to a customer, who is identified or identifiable from that information which includes, but not limited to, the customer’s name, address, identification card number, passport number, banking information, email address and contact details.

2. Introduction

2.1 These Terms apply to and regulate Your use of the DuitNow Transfer service offered by Us. The DuitNow Transfer service allows You to transfer an amount specified by You from Your designated bank or e-money account maintained with Us, to a bank or e-money account maintained by Your recipient at a participating DuitNow Transfer participant via Pay-to-Account-Number and Pay-to-Proxy (Pay via DuitNow ID), or such other means as prescribed by Us or the DuitNow Operator from time to time.

2.2 The DuitNow Transfer service offered by Us is part of the Electronic Banking/e-Money Services, and accordingly, these Terms are in addition to and shall be read in conjunction with the Setel Wallet User Terms and Conditions available at App Usage Terms & Conditions.

3. DuitNow Transfer Services

3.1 If You wish to send funds via DuitNow Transfer, You must first initiate a payment by entering the recipient’s DuitNow ID in Our website and/or application (“App”).

3.2 We will perform a ‘Name Enquiry’ to verify the recipient’s registration of its DuitNow ID in NAD and if the recipient is registered, We will display the name of such registered DuitNow Transfer recipient.

3.3 You are responsible for the correct entry of the recipient’s DuitNow ID and ensuring that the recipient’s name displayed is the intended recipient of the funds prior to confirming the DuitNow Transfer transaction.

3.4 We will notify You on the status of each successful, failed or rejected DuitNow Transfer transaction via any of Our available communication channels chosen by You.

3.5 You acknowledge and agree the We shall have no duty to and shall not be required to take any steps to verify or seek any other confirmation from any party as to whether such registered recipient is the intended recipient, and We shall not be liable for transferring the funds to such registered recipient even if such person is not the intended recipient.

3.6 Pursuant to Clause 2.5 above, You agree that once a DuitNow Transfer transaction has confirmed, it will be deemed irrevocable and You will not be able to cancel, stop or perform any changes to that DuitNow Transfer transaction.

4. Multiple Name Enquiry Requests

4.1 You are advised not to submit multiple “Name Enquiry Requests” without a confirmed DuitNow Transfer transaction. We shall not display the results of the “Name Enquiry Requests” upon 5 consecutive Name Enquiry Requests that are not followed with a confirmed DuitNow Transfer transaction.

4.2 Without prejudice to any of Our rights and remedies, We reserve the right to terminate or suspend Your access to and use of the DuitNow Transfer service where We consider in Our sole discretion that inappropriate, fraudulent or suspicious use is being made of the DuitNow Transfer services, such as where multiple Name Enquiry Requests are submitted without a confirmed DuitNow Transfer transaction. You are advised to contact Us should You encounter any issues relating to the foregoing.

5. Recovery of Funds

5.1 Subject to clause 6 and clause 7 below, You have right in relation to the investigation and recovery of, erroneous payments and unauthorised (includes fraudulent) DuitNow Transfer transactions made from Your account.

6. Erroneous DuitNow Transfer Transaction

6.1 If You have made an erroneous DuitNow Transfer transaction, You may request for recovery of the funds within ten (10) business days from the date the erroneous DuitNow Transfer transaction was made and We will work with the affected recipient’s bank/ e-money issuer to return the said funds to You within seven (7) Business Day provided the following conditions are met:

6.1.1 The funds were wrongly credited into the affected recipient’s account;

6.1.2 If funds have been wrongly credited, whether the balances in the affected recipient’s account is sufficient to cover the funds’ recovery amount;

6.1.2.1 If the balances are sufficient to cover the recovery amount, the erroneously credited funds may be recoverable; and

6.1.2.2 If the balances are not sufficient to cover the recovery amount, the erroneously credited funds may not be fully recoverable and the recipient’s bank/ e-money issuer may partially remit the recoverable fund back to You.

6.2 Request for recovery of funds between eleven (11) Business Days and seven (7) months from the date the erroneous DuitNow Transfer transaction was made:

6.2.1 The affected recipient’s bank/e-money issuer is fully satisfied that funds were erroneously credited to the affected recipient;

6.2.2 Deliver notifications to the affected recipients in writing regarding the funds recovery requests whereby the erroneously credited funds would be recovered through debiting the affected recipients’ accounts within ten (10) Business Days of the notifications unless the affected recipient provides reasonable evidences that the affected recipient is entitled to the funds in question. After fifteen (15) Business Day, if the affected recipients fail to establish their entitlement to the funds, the affected recipient’s bank/ e-money issuer shall debit the affected recipients’ account and remit the funds back to You.

6.3 Requests to recover funds after seven (7) months from the date of the erroneous DuitNow Transfer transaction:

6.3.1 The affected recipient’s bank/ e-money issuer is fully satisfied that funds were erroneously credited to the affected recipient;

6.3.2 The affected recipient’s bank/ e-money issuer shall obtain from the affected recipient the decision whether to grant consent within ten (10) Business Days; and

6.3.3 Once consent is obtained, the affected recipient’s bank/ e-money issuer shall debit the affected recipient’s account and remit the funds back to You within one (1) Business Day.

7. Unauthorised or Fraudulent DuitNow Transfer Transaction

7.1 For DuitNow Transfer transactions which were not authorised by You or which are fraudulent, We will, upon receiving a report from You alleging that an unauthorised or fraudulent DuitNow Transfer transaction was made, remit the funds back to You provided the following conditions are met:

7.1.1 We shall conduct an investigation and determine within fourteen (14) calendar days, if the unauthorised or fraudulent payment did occur;

7.1.2 If We are satisfied that the unauthorised or fraudulent payment Instruction did indeed occur and was not caused by You, We shall initiate a reversal process whereby all debit posted to Your account arising from the unauthorised or fraudulent Payment Instruction would be reversed.

8. Liability and Indemnity

8.1 You acknowledge and agree that, unless expressly prohibited by mandatory laws, We and the DuitNow Operator shall not be liable to You or any third party for any direct, indirect or consequential losses, liabilities, costs, damages, claims, actions or proceedings of any kind whatsoever in respect to any matter of whatsoever nature in connection with the DuitNow Transfer services offered by Us arising from:

8.1.1 Your negligence, misconduct or breach of any of these Terms;

8.1.2 Any erroneous transfer of funds by You, including any transfer of funds to the wrong DuitNow ID, wrong recipient or wrong third party;

8.1.3 The suspension, termination or discontinuance of the DuitNow Transfer services.

8.1.4 Any failure, delay, error or non-transmission of funds due to system maintenance, breakdown or non-availability of any network, software or hardware of Setel and the DuitNow Operator; or

8.1.5 Any unauthorised or fraudulent DuitNow transactions not caused by us or attributable to us.

8.2 You shall indemnify Us, Our affiliates, and the DuitNow Operator harmless from and against any loss or damage suffered due to any claim, demand, or action brought against Us, Our affiliates, and the DuitNow Operator resulting from Your negligent and/ or fraudulent act.

9. General

9.1 We reserve the right to revise at any time, such charges for the use of the DuitNow Transfer services, by providing You with thirty (30) days written notice. Such revisions shall take effect from the date stated in the said notice. Such notice may be published via Setel website (please insert the hyperlink), Setel App and/or through any other mode of communication as determined by Us. It shall be Your responsibility to be informed of or otherwise seek out any such notice validly posted. Where You continue to access or use the DuitNow Transfer services after such notification, You shall be deemed to have agreed to and accepted such revisions to such charges.

9.2 You acknowledge that We may terminate Your use of the DuitNow Transfer services with Us for any reason with prior notice.

9.3 You acknowledge that We have the right to change, restrict, vary, suspend or modify these Terms by providing You with thirty (30) days’ notice in such manner as We deem fit.

9.4 You consent to the collection, use and disclosure of your Personal Data by Us, Our affiliates, Our service providers and the DuitNow Operator as required for the purposes of the DuitNow Transfer services.

9.5 These Terms are governed by and shall be construed in accordance with the laws of Malaysia.

DuitNow NAD Terms & Conditions | Setel

The following Terms and Conditions apply to Users of the Setel App and the Services provided by Setel Ventures Sdn Bhd (Registration No: 201901000991: 1310317-A). By downloading, installing and/or using Setel App and/or the Services, The User unconditionally and irrevocably agrees to be bound by these Terms and Conditions without limitation or qualification.

If The User does not accept these Terms and Conditions, please immediately discontinue the use of the Setel App and/or the Services.

GENERAL

Setel App and the Services are provided by Setel Ventures Sdn Bhd. These Terms and Conditions shall govern The User’s access to and/or use of the Setel App and/or the Services. As long as The User abides by these Terms and Conditions, The User may use the Setel App and the Services in accordance with the terms hereof.

Setel reserves the right to amend, modify, add or remove any provisions under these Terms and Conditions at any time as Setel deems necessary and such changes shall become effective after twenty-one (21) days upon them being uploaded and published by Setel on our website. The User agrees that The User’s continued use of Setel App and/or the Services shall constitute The User’s acceptance of these Terms and Conditions including any term which may have been amended from time to time. The User further agrees that The User shall be solely responsible to regularly check these Terms and Conditions for updates or amendments.

1. DEFINITIONS

Auto Assistance means road assistance services as provided by third party Merchants.

Setel Account means the account registered and maintained by The User in the Setel App..

BNM means Bank Negara Malaysia.

Merchants means the merchants as designated by Setel Ventures Sdn. Bhd who sell goods and/or services and accept payment through the Setel App.

Intellectual Property means any copyright, patent, design, trademark, application to register any of the aforementioned rights, trade secrets, rights in know-how, and any other intellectual or industrial property right of any nature whatsoever subsisting in any part of the world.

Petrol Credit Card means the credit card which offers related benefits such as cashback or reward points for petrol spending. The credit card application service is offered by a third party aggregator who will assist the User on the petrol credit card application submission to respective banks.

PETRONAS Merchants means the merchants as designated by Setel Ventures Sdn. Bhd who sell goods and/or services and accept payment through the Setel App at PETRONAS stations and PETRONAS convenience stores.

Setel Group Privacy Statement means the privacy statement pursuant to Personal Data Protection Act 2010 which is accessible at https://www.setel.com/privacy

Services means the features provided by Setel App which enables The User to perform the transactions set out in the Setel App.

Terms and Conditions means these Terms and Conditions which govern the access to and/or use of Setel App and/or the Services.

Users or The User means the person who registers and accesses the Setel App and/or the Services.

We or Us means Setel Ventures Sdn. Bhd. (“Setel”).

Setel App means the mobile application owned by Setel Ventures Sdn Bhd which is downloaded onto a mobile device.

Setel Wallet means the e-wallet feature belonging to, and controlled by Users, allowing them to make in-app payments via the Setel App.

Family Wallet means a feature that allows the Setel Wallet Owner to share his/her credits in the Setel Wallet with selected friends and family (“Family Wallet Members”).

Family Wallet Owner or Owner means the User who is the owner and main controller of the Setel Wallet, hosting the selected Family Wallet Members.

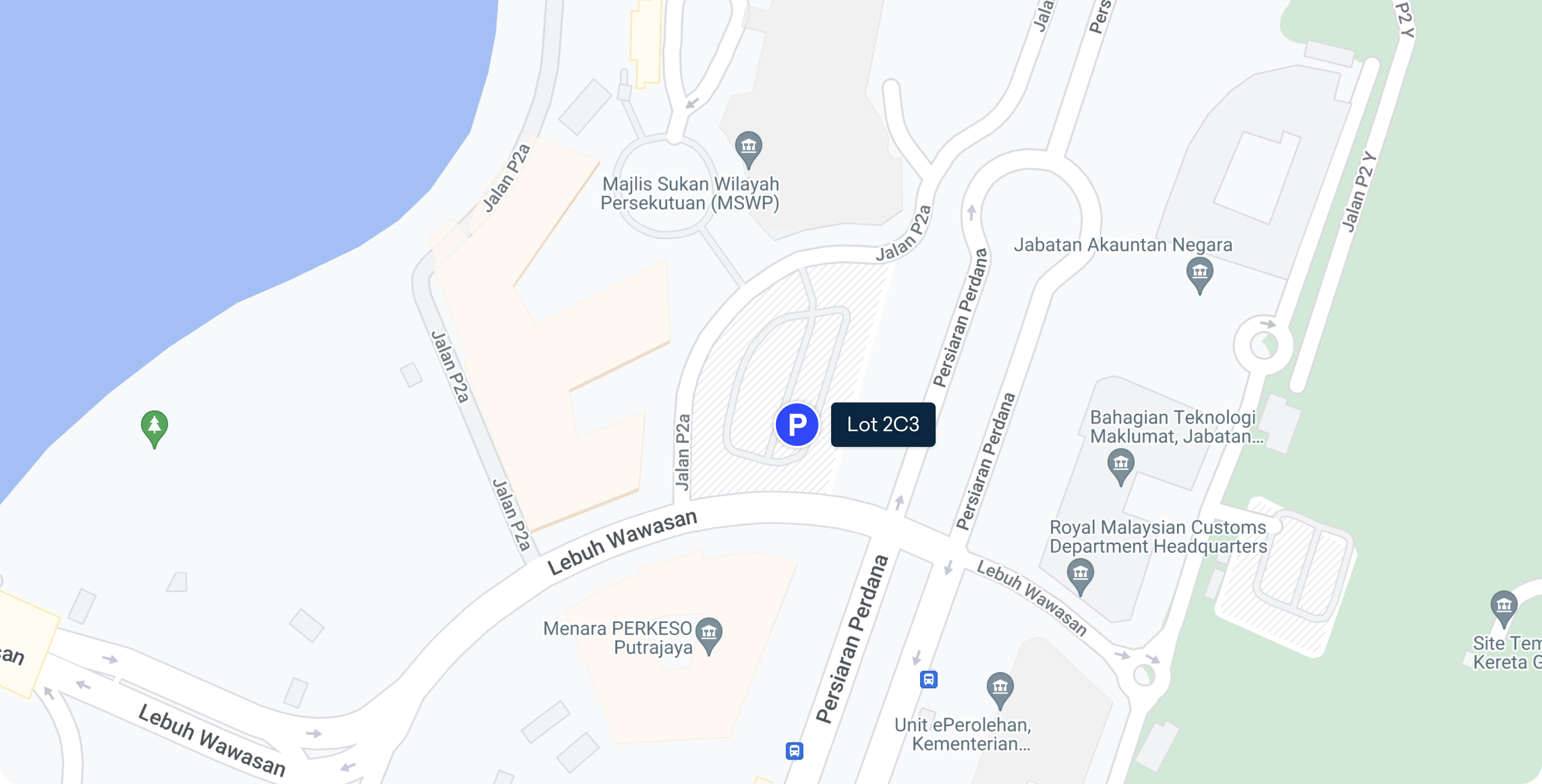

Setel Parking Affiliate means a feature which allows motorists to make parking payments via the Setel App.

CardTerus means the pass-through feature on the Setel App. Setel App will be the proxy for Users to use their credit/debit card(s) for in-app payment of fuel and PETRONAS convenience store (Kedai Mesra) items or items and/or services offered by PETRONAS Merchants. Users will be required to add their preferred cards into their Setel Wallet prior to using this pass-through feature on the Setel App.

Electronic- Know Your Customer (e-KYC) means the electronic process to validate the identity of a user by verifying the personal details of The User.

QR Code payment means static or dynamic Quick Response Code (QR Code) payment method that enables The User to pay with their Setel e-Wallet for purchases from PETRONAS convenience store (Kedai Mesra) and other merchants onboarded by Setel.

Merchant Category Codes (MCCs) means a four-digit number used to describe and classify the type of a merchant’s primary business activities.

MCC 6540 means account reload, or stored value card purchases, and this code shall or may appear when The Users make payments for products and services from Merchants as it indicates a top-up transaction via CardTerus.

E-Commerce transaction (electronic commerce) means purchase of goods and services via the world wide web or the internet.

2. USE OF SERVICE

2.1 By registering for an account in the Setel App, The User warrants and represents that The User has attained eighteen (18) years of age or above. If The User is below the age of eighteen (18) years, The User undertakes that The User shall obtain his/her parent or legal guardian’s consent. The User’s parent or legal guardian shall then be responsible for The User’s usage of the Setel App and /or the Services.

2.2 To use the service, The User needs to download the Setel App on The User’s Mobile Device and register for an account with Setel. Once the Account is created, The User will be able to store/keep prepaid electronic money of up to Ringgit Malaysia Five Hundred (RM500.00) only.

2.3 The User may increase his/her Account limit of up to Ringgit Malaysia Five Thousand (RM5,000.00) only by providing information required by Setel for verification purposes via the Electronic- Know Your Customer (e-KYC) process.

2.4 To use the CardTerus feature, The User will be required to add The User’s preferred cards into the Setel App. This experience will allow a more seamless payment experience with a faster authentication process (via PIN).

2.4.1 The maximum number of cards that can be registered in the Setel Wallet is six (6);

2.4.2 The maximum limit for transactions using the registered cards at PETRONAS convenience stores (Kedai Mesra), petrol stations or the Merchants is RM200.00 per transaction and is cumulatively capped at RM2,000.00 per day;

2.4.3 Any payment for products and/or services from the Merchants shall appear as one (1) single entry in The User’s card statement representing a transaction made to Setel;

2.4.4 Any purchases made via CardTerus from the Merchants shall be classified under MCC 6540 which indicates it is a top-up transaction; and

2.4.5 The top-up transaction (MCC 6540) however will not change the balance in The User’s Setel Wallet as this particular amount will be charged or deducted immediately after the transaction is made.

2.5 To use the Family Wallet feature, the Owner of the Setel Wallet is required to add at least one (1) User to his/her Family Wallet.The User will be automatically added to the Family Wallet and become a Member of the Family Wallet, whilst the Owner will become the official Owner of the Family Wallet. Members will be able to utilise and benefit from the Owner’s Setel Wallet.

2.5.1 The Family Wallet Owner is responsible for the selection of his/her Family Wallet Members, thus great care and consideration must be taken upon selecting and sending the invites. Setel shall not be responsible for any wrongful selections, unauthorised use, losses, reversals, fees, claims, penalties or chargebacks, incurred by the Owner’s Family Wallet Members.

2.5.2 The Family Wallet feature allows up to five (5) Family Wallet Members per Owner only. The number of Family Wallet members would vary, depending on the Owner’s Mesra membership tier. Owners who are at Junior Mesra membership level can have a maximum of 2 members in their Family Wallet, while Owners who are at Explorer Mesra membership level can have a maximum of 3 members in their Family Wallet, and Owners who are at Hero Mesra membership level can have a maximum of 5 members in their Family Wallet.

2.5.3 The Family Wallet Owner will be notified of every purchase made with his/her Setel Wallet and no approval is required prior to each transaction performed by any of the Family Wallet Members.

2.5.4 The Family Wallet feature can only be used if the Owner upgrades his/her Setel Account and once the Owner successfully passes the e-KYC verification process. For the avoidance of doubt, only the Family Wallet Owner will be required to complete this additional step for verification purposes.

2.6 To use the Auto Assistance feature, The User’s name, phone number and vehicle plate number are required to be shared with the relevant Merchant providing such services. The User may refer to the latest Setel Group Privacy Statement as made available on the Setel App and website.

2.6.1 The User is responsible to provide accurate details of his/her car to the selected Merchant and/or workshop.

2.6.2 The User agrees that The User may select the Merchants and services required at his/her own discretion. Any cancellation requests are only permissible prior to payments being made. No changes or cancellations shall be accepted once the payment process has been completed.

2.6.3 Any additional requests or services or payments apart from the ones offered on the Setel App shall be communicated and dealt directly with the selected Merchant, at The User’s own discretion.

2.6.4 The User acknowledges and agrees that the road assistance services are provided by third- party Merchants. Any complications or issues that may arise from the services provided by the third- party Merchants shall be communicated and dealt directly with the Merchants. Any requests pertaining to refunds are subject to our refund policy under Clause 11.8 of this Terms and Conditions.

2.7 To use the Setel Parking Affiliate feature, The User is required to first complete a one-time setup to authorise and to add his/her vehicle plate number(s) on the Setel App.

2.7.1 The User’s name and vehicle plate number will be shared with the Merchant and The User shall be responsible to ensure that the details of his/her car are accurate and up to date.

2.7.2 The User is responsible to ensure that he/she has sufficient balance or amount available on the Setel App in order to use the Setel Parking Affiliate feature smoothly.

2.7.3 The User will be notified if his/her Setel account has insufficient balance. The User must also take note that the transaction will be declined or deemed unsuccessful should this occur.

2.7.4 The User acknowledges and agrees that Setel will not be held responsible for any issues that may arise during the parking exit process due to delayed top-up transactions in The User’s Setel Wallet. Any complications or issues that may arise from the services provided by the parking Merchant shall be communicated and dealt directly with the Merchant. Any requests pertaining to refunds are subject to our refund policy under Clause 11.8 of this Terms and Conditions.

2.7.5 To use the Setel App to make payments for street parking, The User is required to select the parking location and the parking duration with the respective parking fee reflected. Any cancellation requests are only permissible prior to payments being made. No changes or cancellations shall be accepted once the payment process has been completed.

2.8 To purchase or to renew motor insurance via the Setel App, The User is required to fulfil the renewal criteria as specified by the respective insurance providers, namely Generali and Etiqa. The renewal criteria can be found here as well as on the App.

2.8.1 The User is responsible to ensure that all personal details shared are accurate and up-to-date.

2.8.2 The User is responsible to review and confirm the quotation shared by the insurance provider. For a more detailed breakdown, The User may proceed to the quotation service in the Setel App.

2.8.3 Any insurance-related issues once a transaction is done (claims, cancellation, etc.) are handled by the insurance company. The User may contact the customer service department of the respective insurance provider (further information can be found here).

2.8.4 The User acknowledges and agrees that any disputes, claims or refunds pertaining to insurance transactions shall be communicated and dealt directly with the insurance company.

2.9 To use the road tax renewal service on the Setel App, The User is required to fulfil the renewal criteria which includes the following:-

- The User’s insurance has not expired for more than 30 days;

- The User’s insurance is still valid for more than 2 months;

- The User’s vehicle is less than 20 years old;

- The User’s age is between 18-75 years old;

- The User’s vehicle has no outstanding summon that needs to be cleared (blacklisted);

- The User’s vehicle is for personal use only (not for e-hailing purposes)

2.9.1 To renew road tax via the Setel App, The User is responsible to ensure that all details (such as The User’s vehicle plate number, vehicle type, and personal details) shared on the Setel App are accurate.

2.9.2 The User is required to pay the road tax fees in accordance with Peninsular Malaysia’s road tax pricing regardless of the location of the vehicle at the time the road tax is submitted for a renewal application (i.e. if the vehicle is located in Sabah, Sarawak, Pulau Pangkor, Pulau Langkawi or Labuan).

2.9.4 The User is allowed to renew road tax for company-owned vehicles on the Setel App provided that the vehicles are not used for e-hailing purposes. The User shall need to choose “Company Registration No.” in the “ID Type” field and provide the details accordingly.

2.9.5 Once the road tax is shipped, The User may track the progress of his/her road tax delivery upon receiving the tracking code via email from the road tax company. Estimated time of delivery:

- West Malaysia: 3-5 Working Days

- East Malaysia: 5-7 Working Days (if road tax delivery address is located in East Malaysia)

2.9.6 Any road tax-related issues once a transaction is done (changes, errors, cancellation, damages, delays in delivery, etc.) are handled by the road tax company. The User may contact the company’s customer service department at general@obright.asia for assistance regarding any issues pertaining to the road tax renewal.

2.9.7 The User acknowledges and agrees that any disputes, claims, or refunds pertaining to the road tax issuance/renewal shall be communicated and dealt directly with the road tax company at general@obright.asia.

2.10 To apply for a Petrol Credit Card, The User acknowledges and agrees that the application service is provided by a third-party aggregator and approval for the User’s application is subject to the discretion of the third party aggregator and/or the respective banks.

2.10.1 The information and content displayed in relation to the Petrol Credit Card are supplied by the third-party aggregator. Setel strives to ensure that the Petrol Credit Card information displayed on the Setel App is accurate and up-to-date. However, Setel does not warrant or guarantee the accuracy and completeness of the Petrol Credit Card information displayed on the Setel App. All information contained in the Setel App shall only be used for reference only and The User shall not treat it as any advice given by Setel.

2.10.2 The User acknowledges that the Petrol Credit Card application can only be submitted if The User upgrades his/her Setel Account and once The User successfully completes and passes the e- KYC verification process.

2.10.3 The User can only submit a Petrol Credit Card application for himself/herself. The User is not allowed to submit an application on behalf of others. The personal information (full name and ID number) of the Petrol Credit Card application will be verified and collected from the e-KYC verification process accordingly.

2.10.4 By submitting the Petrol Credit Card application, the User agrees to the terms and conditions and further consent for Setel to retain and use his/her personal information and to disclose the personal information to the third party aggregator to process, verify and obtain his/her credit information at any time to evaluate his/her Petrol Credit Card application.

2.10.5 The User agrees that the User may submit the Petrol Credit Card application at his/her own discretion. Once the application is submitted, any application related issues (cancellation, information updates, etc.) are handled by the third-party aggregator. The User acknowledges and agrees that any disputes or issues pertaining to the Petrol Credit Card application shall be communicated and dealt directly with the third-party aggregator. The customer service of the third-party aggregator can be found here.

2.10.6 Any monetary exchange for any financial product (wherever applicable) will be between the User and the respective banks.

2.10.7 Any free gifts offered by the third-party aggregator upon approval of the Petrol Credit Card application are purely under the aggregator’s discretion. Setel has no participation and is not involved in any decision making in relation to the approval of the User’s Petrol Credit Card application and/or the incentives offered by the third-party aggregator or card issuer(s).

2.10.8 The User agrees and acknowledges that making only the minimum payment due can result in a lengthier repayment period and additional costs on top of the outstanding balance. The User also acknowledges that the finance charges imposed on the outstanding balance for the Petrol Credit Card is based on The User’s bank’s tiered pricing structure in accordance with The User’s repayment history. The User is responsible for ensuring that the payments due are timely made and should contact his/her bank in advance to discuss repayment alternatives in the event there are issues for The User to settle the Petrol Credit Card’s outstanding balance. The User shall notify The User’s respective banks immediately in the event that The User’s Petrol Credit Card is lost, stolen, utilised for an unauthorised transaction or if the PIN may have been compromised.

2.11 The User represents and warrants that all information provided to Setel in The User’s Setel Account is true, accurate and complete and that The User agrees to provide Setel with up-to-date information of The User including identification, verification, or other documentation as Setel, BNM or other lawful authorities may request from time to time. Setel has the right to reject The User’s application for a Setel Account without the need to provide any reason.

2.12 The User is responsible for maintaining the security of The User’s log-in details, passcode, passwords and other information in relation to The User’s Setel Account. The User shall not share any details with other parties and shall immediately change The User’s passcode(s) and/or password(s) and inform Setel if The User’s account has been in any way compromised or The User suspects any unauthorised access or use of The User’s Setel Account.

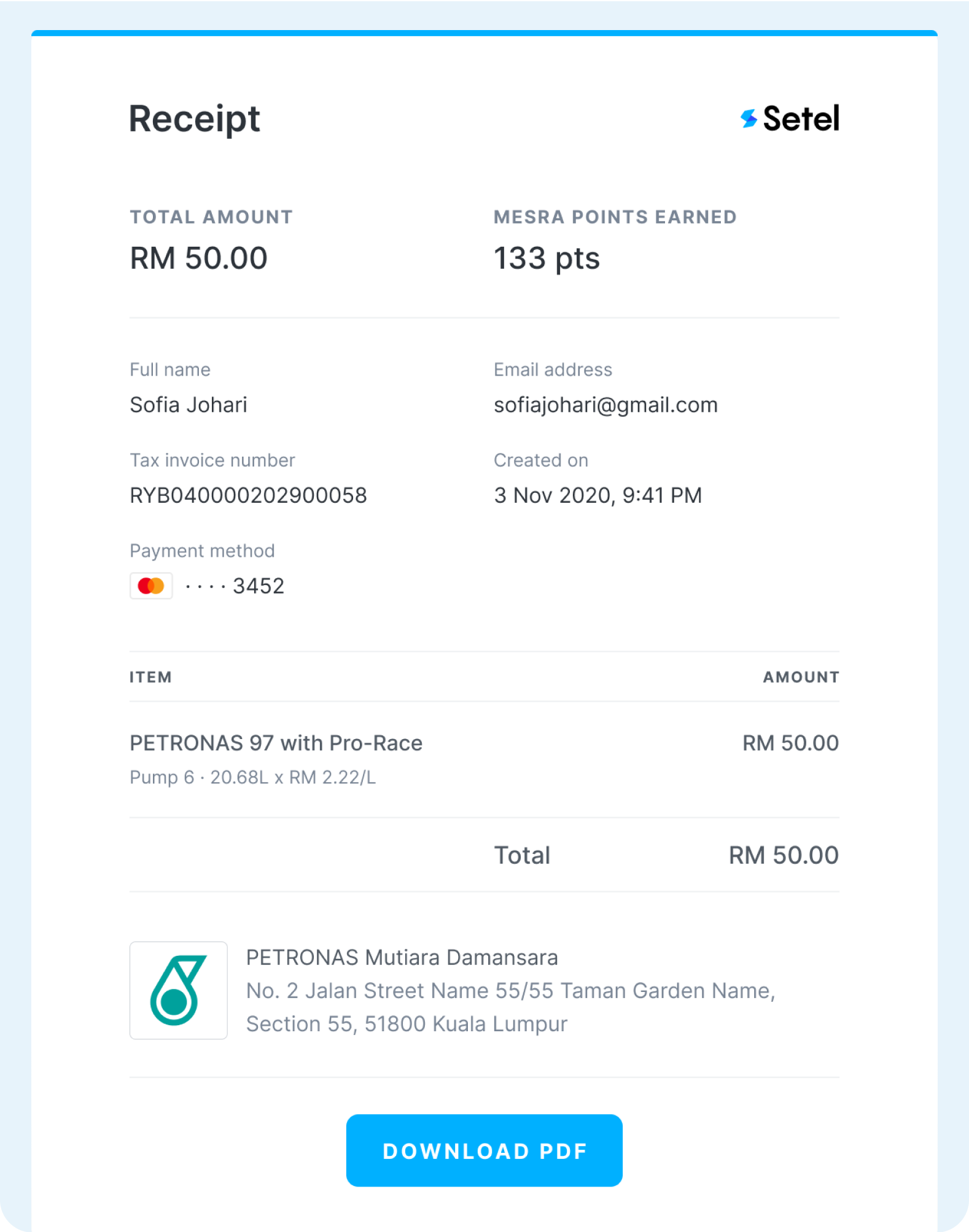

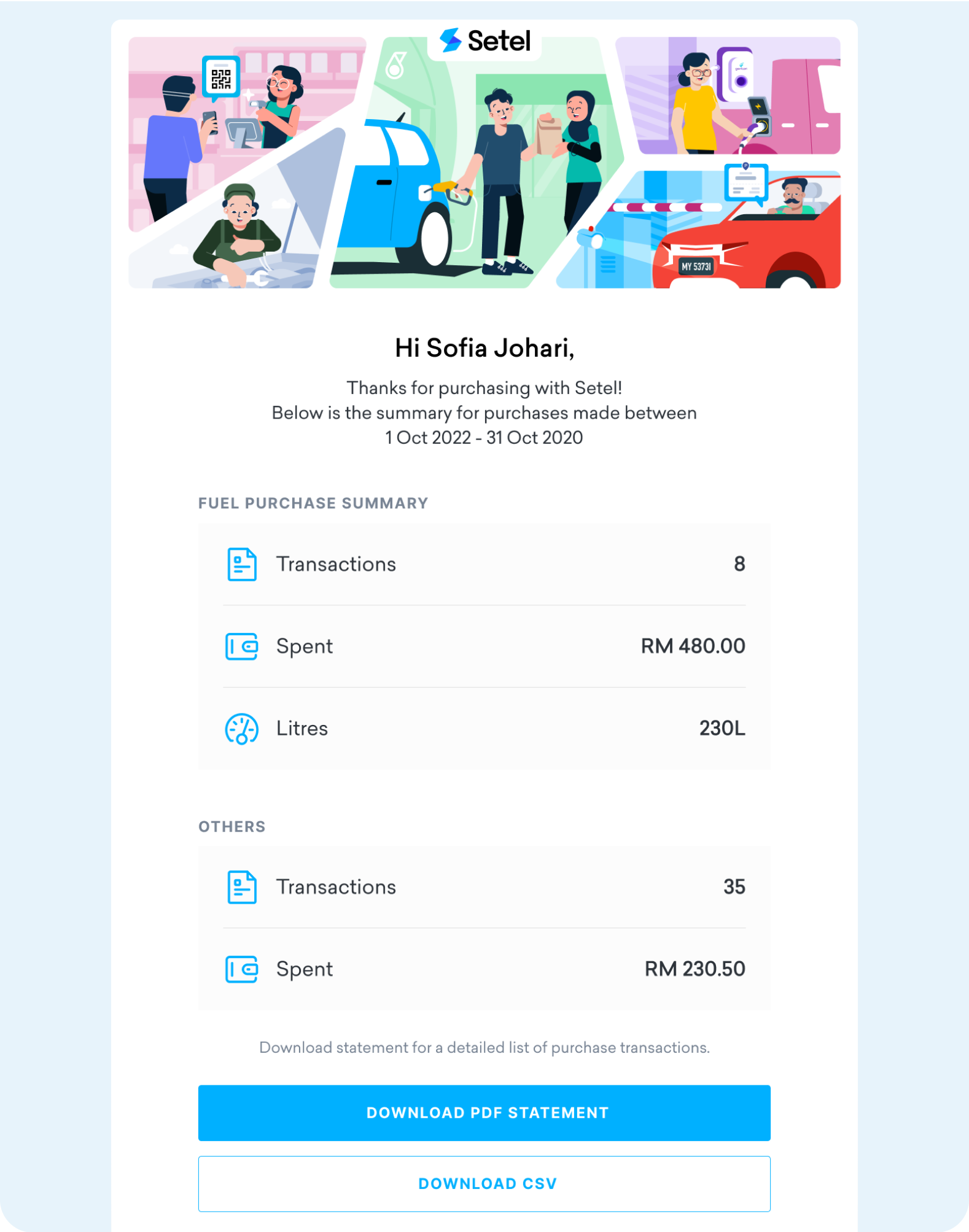

3.0 The User is responsible to check The User’s transaction history regularly. Setel does not provide any hardcopy account statements in respect of the Setel Account. The User shall be responsible for all of The User’s transactions and for keeping track of The User’s Setel Account through The User’s Account history including making regular checks to ensure that The User’s account balance is correct.

2.9 The User’s Setel Account is personal to The User. No person other than The User shall have any right of claim from Setel pertaining to the Setel Wallet balance or other benefits stored in The User’s Setel Account. Any instructions, confirmations and/or communications sent from The User’s account or device shall be deemed to have been issued by The User irrespective of whether such instructions, confirmations and/or communications were actually sent by The User. The User is responsible for securing The User’s own account.

2.10 The User acknowledges and agrees that The User’s Setel Account does not constitute a banking account or any form of term deposit. No interests, dividends or other payments shall be accumulated or payable to The User on the Setel Wallet balance or other benefits held in the Setel Account.

2.11 The User shall not assign, transfer or sub-contract any of The User’s rights or obligations under these Terms and Conditions to a third party.

2.12 The User agrees not to hold Setel liable for any loss or damage whatsoever arising from The User’s failure to keep information relating to The User’s Setel Account secure and confidential, or for any acts or omissions under The User’s account or by using the Setel App and /or the Services.

2.13 The User shall at all times ensure that The User has sufficient funds to carry out any intended ransactions through The User’s Setel Account. If for any reason The User’s account stands in negative balance, The User agrees that this shall constitute a debt owing from The User to Setel and repayable immediately by way of a reload or deposit. The User’s failure to do so promptly shall constitute a breach of these Terms and Conditions and Setel shall be entitled to proceed with such action as Setel deems fit including suspension or termination of The User’s account and commencement of legal action against The User.

2.14 The User agrees that Setel may, at Setel’s sole discretion and without providing any reason to The User, impose a limit on the amount of balance held in The User’s Setel Account, or the number of transactions The User may execute in a specific period of time, or to impose a limit on each transaction amount. The User further agrees that Setel may impose a minimum amount that can be loaded into The User’s Setel Account and the maximum amount permitted to be stored in The User’s Setel Account at any given time. Setel may change these amounts at any time at its sole discretion.

2.15 Setel reserves the right without liability to The User to suspend, modify or discontinue, temporarily or permanently, the Setel App and /or the Services or any feature or part thereof, at our absolute discretion.

2.16 The User’s Setel Account will expire if not used or is inactive for seven (7) years from the last transaction date (inclusive of activation and last reload date). Thereafter, The User’s Setel Account shall no longer be valid for any use and will be deactivated automatically and any credit balance available shall be dealt with in accordance with applicable laws including Unclaimed Moneys Act 1965.

2.17 In the event any fraud, misuse of account or abuse of account in any manner is discovered by Setel, any remaining credit balance in The User’s Setel Account will automatically be forfeited upon deactivation of The User’s Setel Account and such credit balance shall not be refunded to The User.

2.18 Notwithstanding anything to the contrary, if any information provided by The User is untrue, inaccurate, not current or incomplete, Setel has the right to immediately terminate The User’s Account and refuse any and all current or future use of the Services or access to Setel App and/or The User’s Setel Account.

3. USER’S RESPONSIBILITIES

3.1 The User shall:

3.1.1. keep The User’s personal information, passcode, password and/or PIN for The User’s Setel Account confidential at all times and shall take all steps to prevent the disclosure of The User’s passcode, password and/or PIN;

3.1.2. ensure that all information and data provided to Setel including personal data is true, accurate, updated and complete at the time of provision and shall promptly update such information and data if there are any changes to the same. Setel shall not be responsible and liable whatsoever and howsoever to The User due to any inaccurate or incomplete information and data provided to Setel;

3.1.3. warrant to comply with all applicable laws, ordinances, codes, rules, regulations, notices, instructions and/or directives of the relevant authorities or any notices, instructions, directives or guidelines given by Setel;

3.1.4. be responsible for all equipment necessary to use the Setel Account and Services, and also for the security and integrity of all information and data transmitted, disclosed and/or obtained through the use of Setel App and /or the Services;

3.1.5. be responsible and liable for all usage of and all payment of the fees, charges, taxes and duties for using the Services including but not limited to payment of all fee, charges, taxes and duties for the purchase of products and/or services to Setel and third parties including participating Merchants in a timely manner;

3.1.6. be fully responsible for any, and all data transmitted or broadcasted from The User’s mobile device whether by The User or any other person;

3.1.7. comply with all applicable laws of Malaysia relating to the usage of Setel App and /or the Services, including without limitation to the Communication and Multimedia Act 1998, Financial Services Act 2013, Anti Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 and related subsidiary legislations, which may be amended from time to time;

3.1.8. take all reasonable steps to prevent fraudulent, improper or illegal use of the Services;

3.1.9. cease to utilise the Services or any part thereof for such period as may be required by Setel ;

3.1.10. report immediately to Setel upon the discovery of any fraud, theft, loss, unauthorised usage or any other occurrence of unlawful acts in relation to The User’s Setel Account and/or its use. The User agrees to lodge a police report as may be instructed by Setel and to give Setel a certified copy of such report;

3.1.11. only download and install Setel App from the official platform as announced by Setel. Any downloads and installation outside of the official platform shall be deemed unlawful and Setel shall not be liable to The User for any losses suffered by The User arising therefrom;

3.1.12. ensure that The User does not use the Setel App on any illegally modified device such as jailbroken device, rooted device or any device that has been altered in any way whatsoever. In the event that The User uses the Setel App on such devices, Setel shall not be liable in any way whatsoever for any and all losses or damages which The User may suffer including but not limited to, any financial and/or information loss;

3.1.13. be fully responsible for the integrity of all information and data transmitted, disclosed and/or obtained through the use of the Service or broadcasted by The User or any other persons using The User’s Mobile Device;

3.1.14. fully indemnify and shall keep Setel fully indemnified to the fullest extent possible, from and against any and all liabilities, costs, demands or claims whatsoever on a full indemnity basis, which may be made by any third party due to a breach by The User of any of these Terms of Service, or arising in any way from or in connection with The User’s default, acts, omissions and/or negligence in the use of the Setel App and /or the Services; and

3.1.15. agree and consent to the use by Setel and/or its employees, personnel and advisors of any information related to The User, the particulars of the transaction(s) or any designated account relating to the transaction(s) for the purpose of investigating any claim or dispute arising out of or in connection with any disputed transaction(s) and that this consent shall survive the termination of the Service and/or this Agreement. The User further agrees that in the event of a dispute or claim of any nature arising in respect of any transaction, the records of the transaction(s) generated by Setel shall be used as a reference and shall be the sole basis of settling the aforesaid dispute or claim.

3.2 The User shall not:

3.2.1. register for multiple Setel accounts for any unlawful and dishonest purposes such as to gain excessive benefits from the app and/or Services offered on the Setel App;

3.2.2. use Setel App and/or the Services to cause embarrassment, distress, annoyance, irritation, harassment, inconvenience, anxiety or nuisance to any person;

3.2.3. use Setel App and/or the Services to cause excessive or disproportionate load on the Services or Setel’s system;

3.2.4. use Setel App and/or the Services for any unlawful purposes including but not limited to vice, gambling or other criminal purposes whatsoever or for sending to or receiving from any person any message which is offensive on moral, religious, communal or political grounds, or is abusive, defamatory or of an indecent, obscene or menacing character;

3.2.5. use Setel App and/or the Services for any purpose which is against public interest, public order or national harmony;

3.2.6. use, permit or cause any improper use of the Setel App and/or the Services, or contribute directly or indirectly to any activities which may breach any laws, infringe a third party’s rights, or breach any directives, content requirements or codes promulgated by any relevant authorities including activities which will require Setel to take remedial action under any applicable industry code or in a way interferes with other users or defames, harasses, menaces, restricts or inhibits any other users from using or enjoying the Services or the internet;

3.2.7. circumvent user authentication or security of any host, network or account (referred to as “cracking” or “hacking”) nor interfere with services to any other user, host or network (referred to as “denial of service attacks”) nor copy any pages or register identical keywords with search engines to mislead other users into thinking that they are reading Setel’s legitimate web pages (referred to as “page-jacking”), or use Setel App and/or the Services for any other unlawful or objectionable conduct. Users who violate systems or network security may incur criminal or civil liability, and Setel will at its absolute discretion fully cooperate with investigations of suspected criminal violations, violation of systems or network security under the leadership of law enforcement or relevant authorities;

3.2.8. attempt to probe, scan or test the vulnerability of any of Setel system or network or breach any security or authentication measures;

3.2.9. avoid, bypass, remove, deactivate, impair, descramble or otherwise circumvent any technological measure implemented by Setel or any of the service providers or any other third party (including other users) appointed by Setel to protect our ability to provide the Services;

3.2.10. attempt to download Setel App for the use of the Services through the use of any engine, software, tool, agent, device or mechanism (including spiders, robots, crawlers, data mining tools or the like) other than the software and/or search agents provided by Setel or other approved third-party web browsers;

3.2.11. copy, disclose, modify, reformat, display, distribute, license, transmit, sell, perform, publish,transfer and/or otherwise make available any of the Services or any information obtained by The User while using the Services or while accessing the Setel App;

3.2.12. remove, change and/or obscure in any way anything on Setel App and/or the Services or otherwise use any material obtained whilst using Setel and/or the Services except as set out in these Terms and Conditions;

3.2.13. copy or use any material from Setel App and/or the Services for any commercial purposes, remove, obscure or change any copyright, trademark or other Intellectual Property right notices contained in the original material, or from any material copied or printed off from Setel App, or obtained as a result of the Services;

3.2.14. use any of Setel’s trademarks, logo, URL or product name without Setel’s express written consent;

3.2.15. attempt to decipher, decompile, disassemble or reverse engineer any of the software used by Setel in Setel App and in providing the Services;

3.2.16. fraudulently register a Setel Account. If The User is caught impersonating another person, whether an individual or another legal entity, The User will be responsible for any costs and/or losses incurred as a result of The User’s fraudulent activity. Abusing the Setel Account may result in immediate termination / suspension of account followed by a report to the relevant authorities; or

3.2.17. use Setel App to engage in money-laundering, terrorism financing, drug trafficking, wagering or other fraudulent, illegal or criminal activities or any activities against the law. Abusing the Setel Account may result in immediate termination / suspension of account followed by a report to the relevant authorities. In the event that an account is identified to be used for suspicious activities, The User’s account information and/or transactions shall be shared with the relevant authorities and third parties for investigation purposes, in accordance with our Setel Group Privacy Statement.

4. TERMS OF USE FOR PURCHASE OF PETROL

4.1 The User agrees that The User will not purchase fuel or otherwise use the Setel App to purchase fuel if:

(a) The User is under 16 years of age;

(b) The User does not have a motor vehicle or a suitable portable container or a demountable fuel tank to fill whilst The User is on the PETRONAS retail forecourt;

(d) at any time that The User is out of The User’s vehicle and on the PETRONAS retail site forecourt.

4.2 The User agrees that The User will always comply with the relevant PETRONAS station safety rules and regulations while purchasing fuel and using the Setel App.

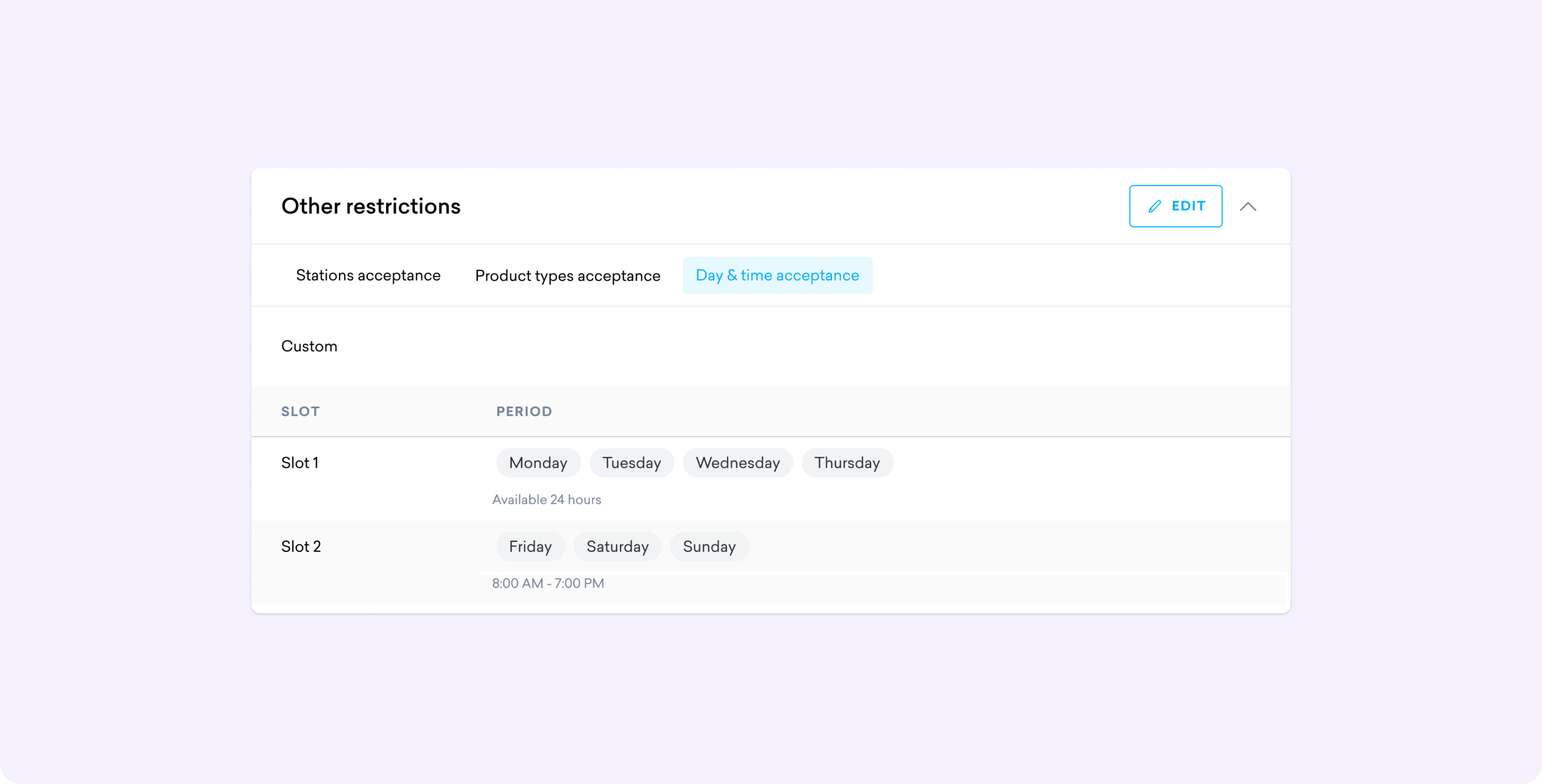

4.3 The service of “Purchase Petrol” can only be used to purchase fuel and is only available at selected PETRONAS stations and during the relevant stations’ operating hours, subject to changes in the operating hours.

4.4 Some fuel pumps may not be available for use through “Purchase Petrol” at certain PETRONAS stations. The” Purchase Petrol” option shall not appear in the “Purchase Petrol” menu when The User uses” Purchase Petrol” at that particular PETRONAS station.

5. INTELLECTUAL PROPERTY RIGHTS

5.1 The User shall use Setel App and /or the Services strictly in accordance with these Terms and Conditions and shall not:

5.1.1. decompile, reverse engineer, disassemble, attempt to derive the source code or decrypt Setel App;

5.1.2. make any modification, adaptation, improvement, translation or derivative work from Setel App;

5.1.3. violate any applicable laws, rules or regulations in connection with The User’s access or use of Setel App;

5.1.4. remove, alter or obscure any proprietary notice in connection with Setel App;

5.1.5. use Setel App for any revenue-generating endeavour, commercial enterprise or other purposes for which it was not designed or intended;

5.1.6. use Setel App for creating a service, product or software which directly or indirectly competes with, or substitutes the Services offered by Setel through Setel App;

5.1.7. use Setel App to send out spams or unsolicited emails; or

5.1.8. use any of Setel’s Intellectual Property or other proprietary information in the design, development or distribution of any applications, accessories, or devices for use with the Setel App.

5.2 All Intellectual Property in connection with Setel App, which includes all graphics, text, photographs, artwork, logos, user interfaces, sounds, music, computer code, the design, “look and feel”, expression and arrangement of the application, is owned, controlled by or licensed to Setel Ventures Sdn. Bhd and/or protected by copyright, trademark or other Intellectual Property rights. Save as expressly provided herein, no license is granted to The User with respect to Setel’s Intellectual Property and The User shall not use, copy, reproduce, transmit or distribute any component or part of Setel’s Intellectual Property without Setel’s prior written consent.

6. CHARGES

6.1 Setel reserves the right to impose any charges, fees or subscriptions for the use of certain Services, if such charges are required. Setel shall notify The User of any changes to the fees and charges imposed by giving a twenty-one (21) day notice prior to the effective date of the fees and charges.

6.2 In accessing and using Setel App and/or Services, The User shall be fully responsible and liable for all charges and payment due to The User’s communications services provider to access Setel App and the Services including but not limited to telephone charges and internet/data charges.

7. DISCLAIMER

7.1 The Services are provided on an “as is” and “as available” basis. Setel makes no representation or warranty, express or implied, that the Services or any feature thereof shall always be reliable, timely, secure or defect free, or that the Services will be uninterrupted and available at all or any particular time or location. The User accepts that Setel does not represent or warrant that the platform, system or software will be error-free at all times. The User is also aware and acknowledges that the Services rely on third party technologies and facilities including wireless connectivity which is not within Setel’s control. The User acknowledges the characteristics and limitations of digital and wireless networks and that data may be corrupted, delayed or lost despite security and other measures taken by Setel. The User agrees not to hold Setel liable for any failures as highlighted above.

7.2 The User expressly agrees that The User’s use of the Services is at The User’s sole risk and discretion and The User will assume total responsibility arising therefrom. The User shall rely on The User’s own review and evaluation of the Services to assess its suitability for The User’s particular purpose. The User’s sole remedy against Us in the event of dissatisfaction is to cease using the Services.

8. LIABILITY

8.1 Setel’s obligations hereunder are strictly to provide the Services. Setel shall not be liable for the goods, services or any transaction beyond the provision of payment features provided by the Setel App which The User conducts with Merchants or other parties via The User’s Setel Account. The User shall resolve all, and any dispute as to quality, safety, merchantability, legality, or any other matters directly with the relevant Merchants and/or PETRONAS Merchants

8.2 The User shall be solely responsible for any fees charged by merchants, banks or other third parties, and/or the payment of any taxes and any other duties or charges arising from the transaction undertaken between The User and the Merchants.

8.3 Setel shall not in any event be liable or responsible to The User and/or any third party for any costs, loss or damages whether arising directly or indirectly, or for loss of revenue, loss of profits or any consequential loss whatsoever as a result including but not limited to the insolvency of Setel, stolen e-money instruments, fraudulent transactions or The User’s usage of the Setel App.

9. DISPUTE RESOLUTION

9.1 Any disputes regarding The User’s Setel Account and/or transactions made through The User’s Setel Account must be communicated in writing to our customer service, as provided in Clause 11 herein within one (1) month from the date of such transaction(s) and The User shall furnish all necessary supporting documents as and when requested.

9.2 If Setel does not receive any written notice within one (1) month from the date of the transaction(s), The User is deemed to have agreed that the transaction(s) are accurate.

9.3 The User agrees and consents to the disclosure and release by Setel of any information in our possession for the purpose of investigating any dispute arising out of or in connection with the transaction(s) through The User’s Setel Account.

10. TERMINATION AND SUSPENSION

10.1 The User may terminate The User’s Setel Account by contacting Setel by email at hello@setel.com.

10.2 Setel may, without notice, suspend the Services from time to time in the event of any security concerns or unexpected technical, system, maintenance, modifications, fixes, bugs or other related issues.

10.3 Setel may, without notice suspend The User’s Setel Account at any time in the event of any suspicious or fraudulent activity or The User’s violation of any of the Terms and Conditions herein.

10.4 The User’s Setel Account may be suspended in the event that it is dormant, or no transactions have been affected by The User through Setel for a period in excess of six (6) months. The User will be required to contact Setel to reactivate The User’s account and Setel reserves the right to charge a reactivation fee.

10.5 The User agrees that Setel may at any time, with or without prior notice and as Setel deems fit or necessary, suspend or terminate The User’s Setel Account or the Services generally for causes including but not limited to, the following: –

10.5.1. The User is in breach of any of these Terms and Conditions;

10.5.2. Setel has reasons to believe that The User’s Setel Account is used in connection with any fraudulent, criminal or other illegal activities;

10.5.3. if Setel detects any misuse or abuse of the Services;

10.5.4. if Setel ceases for whatsoever reason to provide any or all the Services; and

10.5.5. At the request of BNM or any governmental or law enforcement body or agency.

10.6 In the event that Setel terminates The User’s Setel account, all pending transactions and any fees or sums due to Setel or other parties will be processed and deducted prior to effective termination. Any remaining credit balance in The User’s Setel Account will automatically be forfeited upon termination and cannot be refunded to The User.

11. REFUND POLICY

11.1 Upon a termination request of The User’s Setel Account made by The User, The User is entitled to obtain a refund of any available balance in The User’s Setel Account. The User shall ensure that The User provides Setel the correct details of The User’s own bank account and any other information as may be required by Setel to enable the refund process, where the amount will be refunded back into The User’s bank account within fourteen (14) calendar days from the date the claim is made by The User, except for complex refund cases, in which the refund process will be completed within thirty (30) days.

11.2 If The User intends to request for a refund in respect of any fees or payments made towards purchases and/or Services offered through The User’s Setel Account, please contact Setel at hello@setel.com, subject to Setel determining to Setel’s satisfaction that The User’s balance was wrongly deducted from The User’s Setel Account due to:

11.2.1. technical error of Setel where The User’s attempted transaction did not go through; or

11.2.2. goods or Services purchased through the Setel App were not available, issued or delivered after payment was made.

11.3 Setel reserves the right not to refund any disputed amount arising from disputed transaction(s) to The User if Setel believes that The User has acted contrary to these Terms and Conditions.

11.4 In the event The User’s Setel Account is terminated or suspended by Setel due to fraudulent, illegal, unlawful transactions or money laundering suspicions including but not limited to, breaches of any law or regulations, it shall be lawful for Setel to retain for an indefinite period or release to the relevant authorities the balance in The User’s Setel Account in accordance with applicable legislation, regulation and/or guidelines. The User shall not be entitled to claim any form of compensation from Setel for any loss arising therefrom.

11.5 Kindly note that there will be no refund under any circumstances whatsoever of any amount received by The User as a reward/bonus/cashback through the usage of the Setel App.

11.6 Any eligible refunds of amounts which were reloaded via credit card will be made back to the credit card account used for the reload.

11.7 Setel may sell or issue vouchers representing the value of Setel App credit for use within the Setel App (“Setel Voucher”). Setel Vouchers received or acquired from any parties are not re-sellable, refundable, exchangeable, and cannot be replaced once issued by Setel. Setel Vouchers shall not be purchased at a discount under any circumstances. The User shall be solely responsible for any damage, loss and/or expiry of the Setel Voucher. For the avoidance of doubt, Setel shall not refund, exchange, and/or replace the Setel Voucher for any reason whatsoever.

11.8 Setel shall not be held responsible for any refund requests made pertaining to unauthorized purchases and/or payments for products and/or services associated with the Merchants or PETRONAS Merchants made via The User’s Setel Account. This matter shall be dealt directly with the third party providing such product and/or services, except in cases where the payment process is not successfully completed due to technical errors on the Setel App.

12. CUSTOMER SERVICE

12.1 The User may address any queries or complaints in relation to the Setel App or the Services via email at hello@setel.com.

12.2 If the reply to The User’s query or complaint is not satisfactory or does not answer or resolve the User’s concerns, The User may then contact the following bodies:

Bank Negara Malaysia

Laman Informasi Nasihat dan Khidmat (LINK)

Ground Floor, D Block,

Jalan Dato’ Onn,

50480 Kuala Lumpur

Contact Centre (BNMTELELINK)

Tel : 1-300-88-5465 (Overseas: 603-2174-1717)

Fax: 603-2174-1515

Email: bnmtelelink@bnm.gov.my

Ombudsman for Financial Services (664393P)

(formerly known as Financial Mediation Bureau)

14th Floor, Main Block,

Menara Takaful Malaysia,

No. 4, Jalan Sultan Sulaiman,

50000 Kuala Lumpur.

13. SETEL GROUP PRIVACY STATEMENT

13.1 The User agrees to Setel’s Setel Group Privacy Statement, which shall be deemed to be incorporated herein by reference and accepts that it forms an essential and integral part of these Terms and Conditions. This Terms and Conditions shall be read together with Setel Group’s Privacy Statement which can be accessed at https://www.setel.com/privacy.

13.2 The User consents to our use of The User’s personal data in accordance with the terms of our Setel Group Privacy Statement and for The User’s personal data to be used and/or disclosed in accordance with the Personal Data Protection Act 2010. The User agrees that by registering an account with Setel and/or by using Setel and the Services, The User has authorised and consented to The User’s personal data being disclosed to and/or stored and/or processed by such third parties as may be necessary for the purposes of providing the Services to The User.

13.3 The User grants Setel consent to confirm on The User’s personal data with other entities or agencies in order to verify The User’s identity and/or to comply with any legal or regulatory requirements in connection with the Services.

13.4 The User accepts that We may be required to revise our Setel Group Privacy Statement from time to time. All revisions will be promptly notified through our website. The User’s continued use of Setel App and/or the Services shall mean that The User has agreed and consented to our Setel Group Privacy Statement as revised.

14. GENERAL

14.1 Governing Law and Jurisdiction

These Terms and Conditions are governed by and construed in accordance with the laws of Malaysia, and both parties hereby submit to the exclusive jurisdiction of the Malaysian courts.

14.2 Severability

If any one or more of the provisions or terms therein is held by a court of competent jurisdiction to be invalid, void, illegal or unenforceable, the remaining provisions or terms or part thereof shall not in any way whatsoever be affected or impaired or invalidated thereby.

14.3 Assignment

Setel may assign or novate these Terms and Conditions to any third party by written notice to The User and The User shall do all things necessary including but not limited to, executing such documents as may be reasonably required to give effect to such assignment or novation.

14.4 Forbearance

14.4.1 No forbearance whether intentionally or otherwise for the time being granted or shown by Setel shall release or discharge The User or in any manner affect or prejudice Setel’s rights at any time to require strict or full performance by The User of any or all of the provisions of or The User’s obligations under this Terms and Conditions.

14.4.2. Without limiting the meaning thereof, “forbearance” shall be construed to include waiver or failure to require performance of any of the terms in these Terms and Conditions, time or indulgence granted or shown to The User.