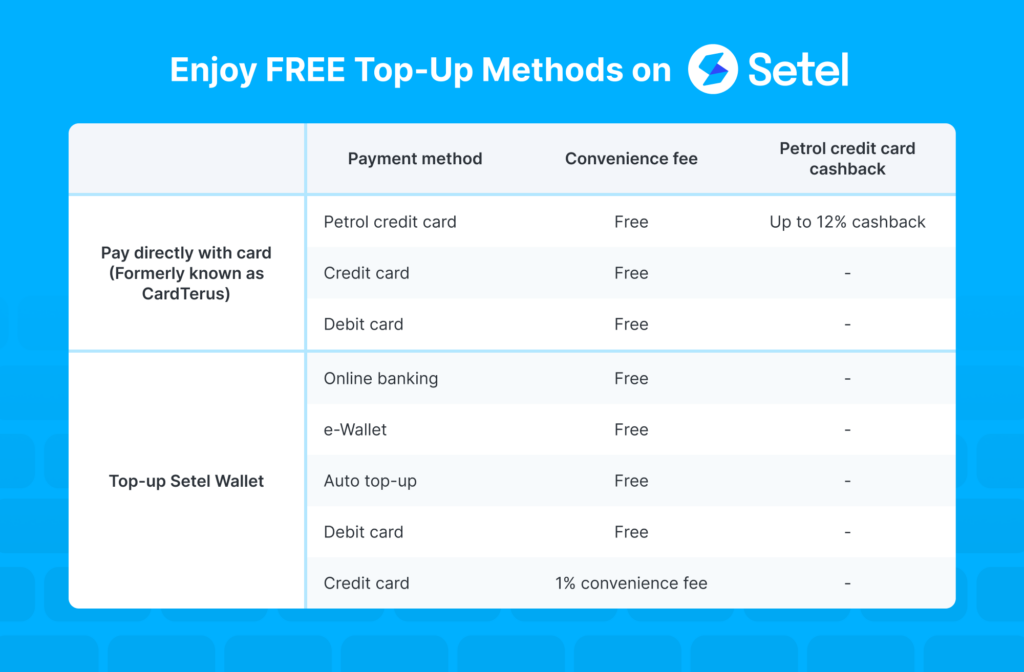

Setel, Malaysia’s first mobile application for seamless fuel payments and rewards, encourages Malaysians to take advantage of seven (7) alternative fee-free top-up methods in line with the implementation of 1% convenience fee for credit card top-up starting 5 December 2024.

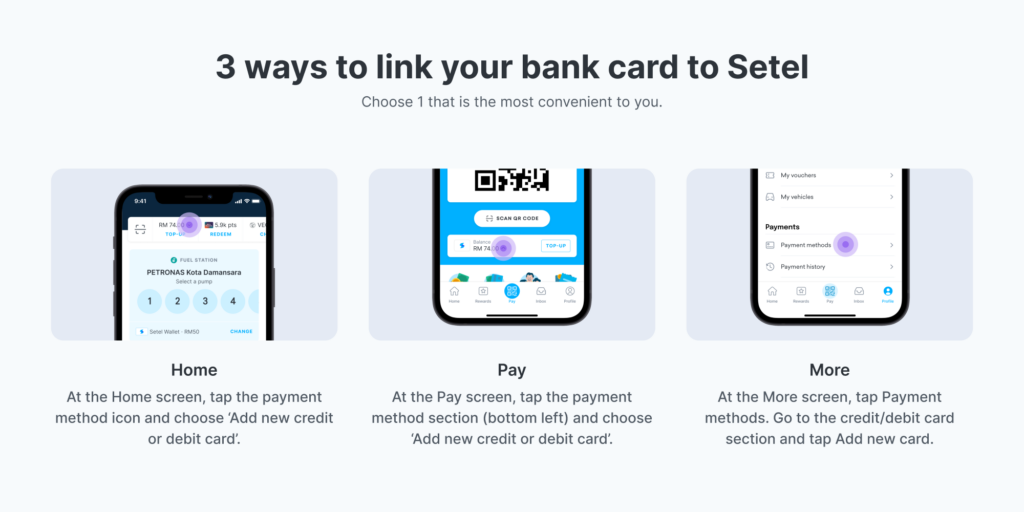

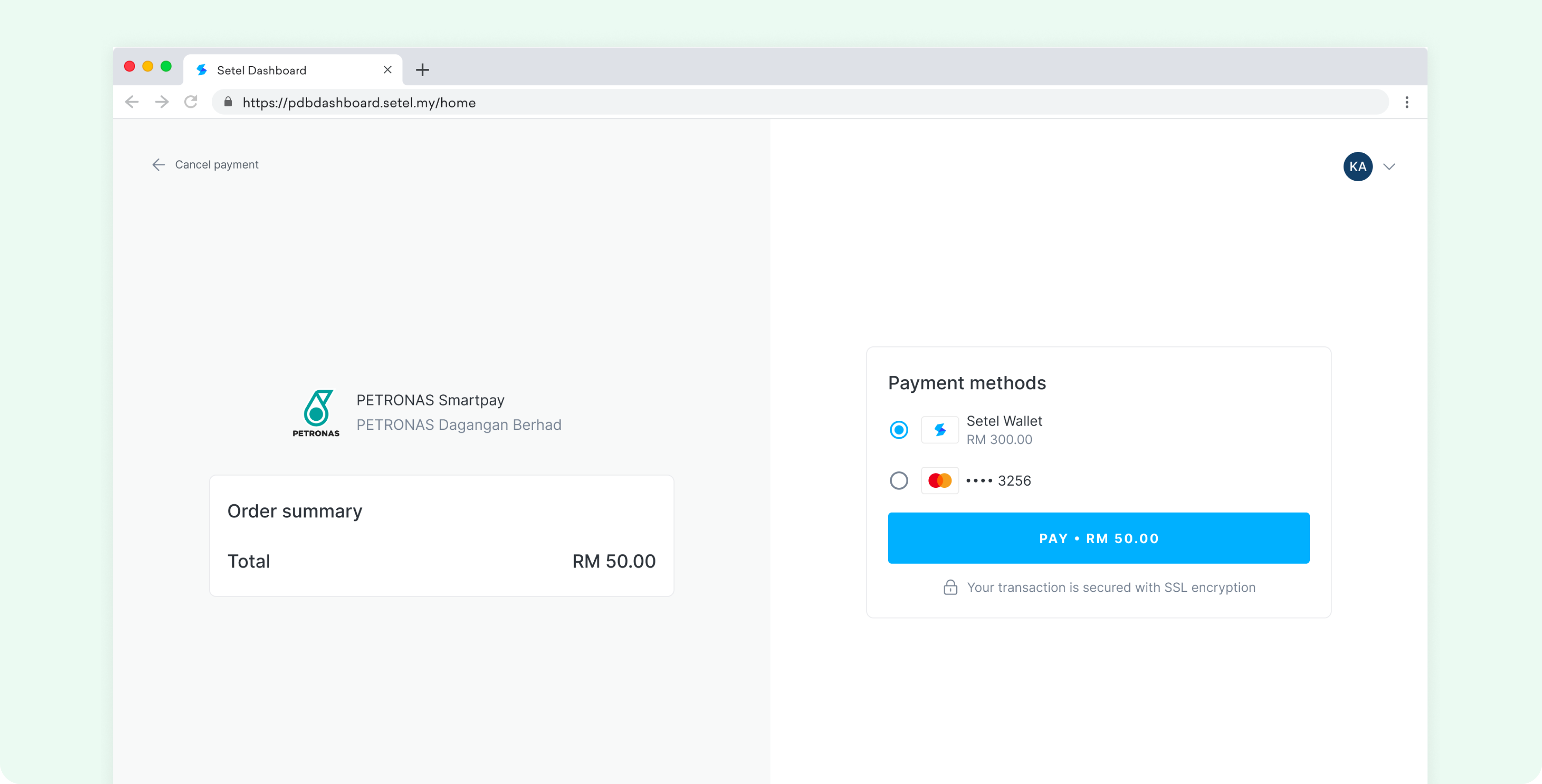

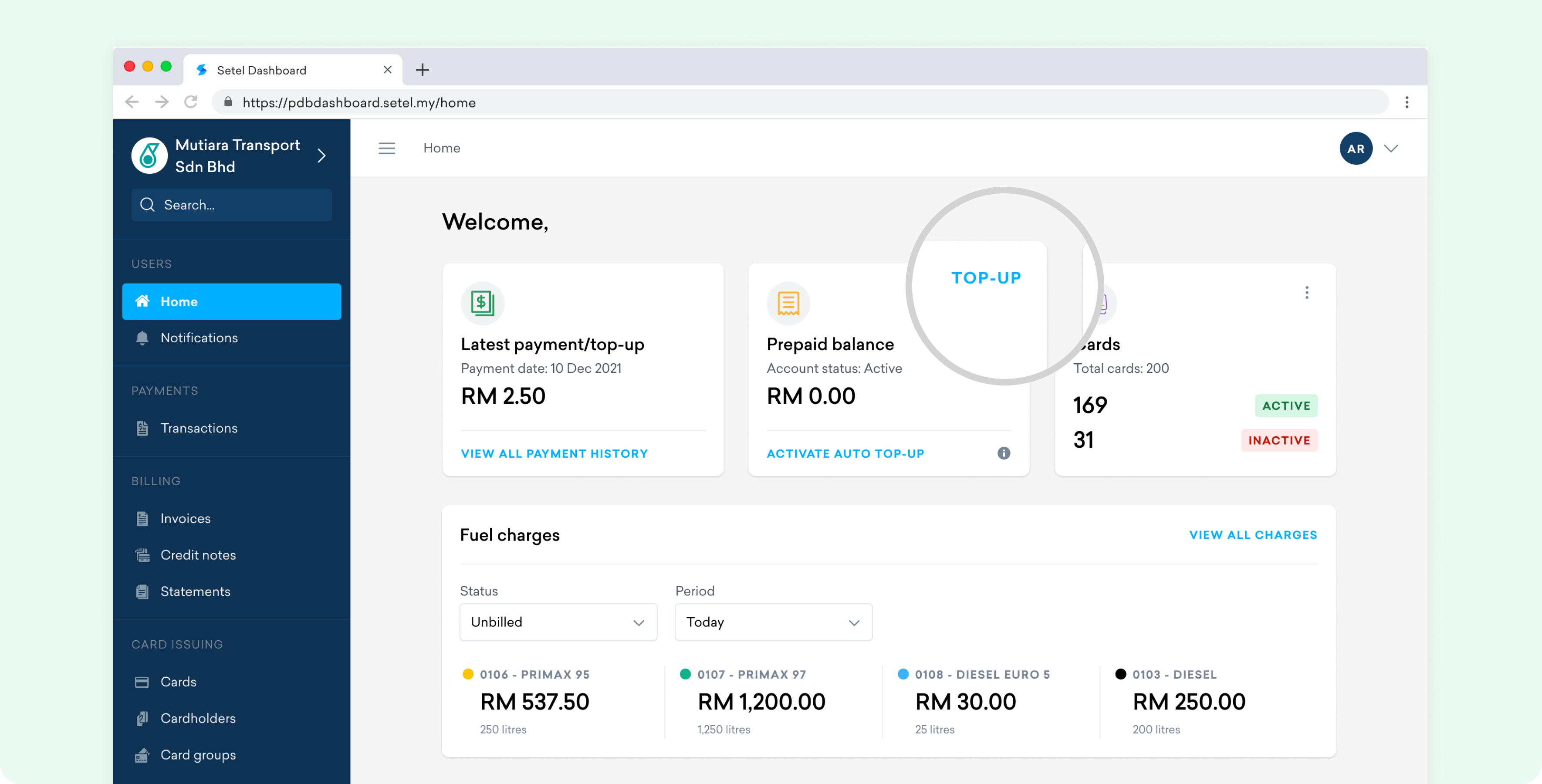

The new fee for credit card top-ups aligns with industry practices among e-Wallets in Malaysia, targeting the prevention of fund misuse via credit card reloads. However, Setel remains committed to customer choice by providing a range of fee-free top-up options, including online banking, e-Wallets, debit cards, and CardTerus – a feature allowing users to add their credit or debit card for direct payment without added fees.

These alternatives are all designed to provide customers with greater flexibility and control over their top-up methods, ensuring a seamless, secure, and cost-effective experience.

“Our users are our top priority. At Setel, we’re all about giving our users the best value. With seven fee-free top-up options, including CardTerus for seamless credit card payments, you can choose the method that suits you best,” said Abdullah Ayman Awaluddin, CEO of Setel Ventures Sdn. Bhd.

For those seeking extra savings, Setel recommends using petrol credit cards for additional cashback and rewards, with some offering up to 12% cashback. Simply add your preferred petrol credit card to your Setel account and pay directly via CardTerus. To learn more, visit https://www.setel.com/features/petrol-credit-card.

To know more about the 1% convenience fee, kindly visit https://www.setel.com/convenience-fee.

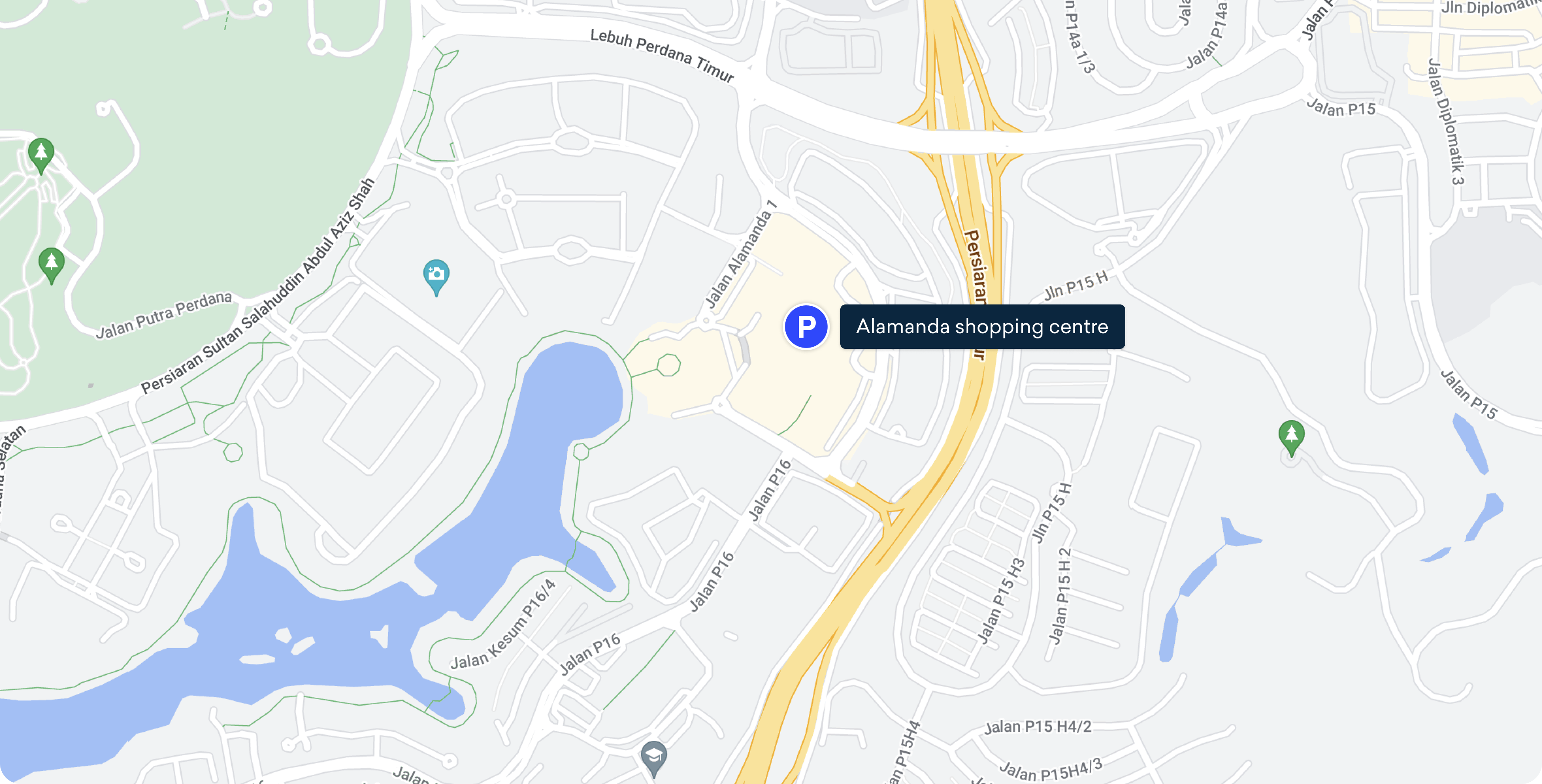

CARs AEON Mall KB